About Mainstay

Mainstay is an employee owned human capital advisory firm; rooted in private markets and active internationally.

It is our mission to provide you with the backbone, foundation, mainstay necessary to meet your human capital challenges within this space.

From executive search and advisory services to board consulting and concierge networking, all of our solutions are tailor made to fit your particular need.

Private Markets

An essential part of the investment world.

Investing in private markets can hardly be seen as an “alternative” anymore. In fact, private equity, private debt, infrastructure, venture capital and even engaged liquid strategies have become an integral part of institutional investors’ portfolios.

At Mainstay, we work with GPs, LPs, Fund of Funds, and Placement Agents to attract, retain, and develop the highest caliber talent across all functions and upper seniority levels.

Private Equity

Continued strong momentum is leading to increased institutionalization, sector differentiation, a broadening of strategies, and a highly competitive talent market.

Click for examples of how we help our clients in the PE space.

- Building up new offices, especially in the DACH region (direct investment, origination, and fundraising)

- Establishing and expanding sector teams across northern Europe

- Growing execution and origination expertise

- Building portfolio monitoring / solutions / quant teams

- Establishing or growing institutional fundraising expertise

- Growing or changing internal senior operations teams (finance, HR, management)

Private Debt

Structural growth in the private credit space, particularly in Europe, continues unabated, thus, leading to new strategies and the need to be creative when hiring.

Click for examples of how we help our clients in the private debt space.

- Building up new offices, especially in the DACH region (direct investment, origination, and fundraising)

- Building up teams around direct lending, special situations / credit opportunities, and direct corporate debt financing solutions in northern Europe

- Strong focus on effective sponsor coverage and networks

- Establishing or growing institutional fundraising expertise

- Growing or changing internal senior operations teams (finance, HR, management)

Venture Capital

Venture capital is not only gaining in importance in Northern Europe, it is also becoming increasingly more sophisticate and institutionalized.

Click for examples of how we help our clients in the venture capital space:

- Building up new offices, especially in the DACH region (direct investment, origination, and fundraising)

- Building sophisticated investment expertise, with particular focus on strong analytical skills paired with business acumen and networking abilities

- Helping to build teams that are effective and proven sparring partners for portfolio companies throughout all phases of the investment

- Help establish effective corporate venture units that can operate within (or outside of) the corporate structure

Infrastructure

From traditional Core/Core+, and renewables projects to smart grid and environmentally focused initiatives, the infrastructure space continues to grow and evolve.

Click for examples of how we help our clients in the infrastructure space:

- Building up new offices, especially in the DACH region (direct investment, origination, and fundraising)

- Focus both on active underwriting as well as co-investment expertise across the different strategies

- Coverage of direct- and fund-investment expertise as well as asset management

- Establishing or growing institutional fundraising expertise

- Growing or changing internal senior operations teams (finance, HR, management)

Engaged Public Equity

Although a comparatively niche strategy, engaged listed equity strategies are proliferating and offer highly effective PE-like exposure, yet with greater liquidity.

Click for examples of how we help our clients in the engaged public equity space:

- Building up new offices, especially in the DACH region

- Establishing diverse teams with backgrounds in private equity, consulting, equity research and investment banking

- Establishing or growing institutional fundraising expertise

- Growing or changing internal senior operations teams (finance, HR, management)

Private Equity and Venture Capital Portfolio Companies

Creating value in portfolio companies is the highest priority – either through growth, turn-around, or other strategies. Identifying, securing, and developing the talent responsible for this growth is the name of the game.

Click for examples of how we help our PE and VC clients build and strengthen their portfolio management teams:

- Helping assess management teams during the due diligence phase and starting discreet searches, if necessary

- Building new management teams from scratch or helping change C-suite on an individual basis. Focus on CEO, CFO, COO, CTO roles

- Guiding process around Board appointments and functions

- Helping restructure management expertise and reporting lines

Private Markets

An essential part of the investment world.

Investing in private markets can hardly be seen as an “alternative” anymore. In fact, private equity, private debt, infrastructure, venture capital and even engaged liquid strategies have become an integral part of institutional investors’ portfolios.

At Mainstay, we work with GPs, LPs, Fund of Funds, and Placement Agents to attract, retain, and develop the highest caliber talent across all functions and upper seniority levels.

Private Equity

Continued strong momentum is leading to increased institutionalization, sector differentiation, a broadening of strategies, and a highly competitive talent market. Click for examples of how we help our clients in the PE space.

read more

- Building up new offices, especially in the DACH region (direct investment, origination, and fundraising)

- Establishing and expanding sector teams across northern Europe

- Growing execution and origination expertise

- Building portfolio monitoring / solutions / quant teams

- Establishing or growing institutional fundraising expertise

- Growing or changing internal senior operations teams (finance, HR, management)

Private Debt

Structural growth in the private credit space, particularly in Europe, continues unabated, thus, leading to new strategies and the need to be creative when hiring. Click for examples of how we help our clients in the private debt space.

read more

- Building up new offices, especially in the DACH region (direct investment, origination, and fundraising)

- Building up teams around direct lending, special situations / credit opportunities, and direct corporate debt financing solutions in northern Europe

- Strong focus on effective sponsor coverage and networks

- Establishing or growing institutional fundraising expertise

- Growing or changing internal senior operations teams (finance, HR, management)

Venture Capital

Venture capital is not only gaining in importance in Northern Europe, it is also becoming increasingly more sophisticate and institutionalized. Click for examples of how we help our clients in the venture capital space:

read more

- Building up new offices, especially in the DACH region (direct investment, origination, and fundraising)

- Focus both on active underwriting as well as co-investment expertise across the different strategies

- Coverage of direct- and fund-investment expertise as well as asset management

- Establishing or growing institutional fundraising expertise

- Growing or changing internal senior operations teams (finance, HR, management)

Infrastructure

From traditional Core/Core+, and renewables projects to smart grid and environmentally focused initiatives, the infrastructure space continues to grow and evolve. Click for examples of how we help our clients in the infrastructure space:

read more

- Building up new offices, especially in the DACH region (direct investment, origination, and fundraising)

- Building sophisticated investment expertise, with particular focus on strong analytical skills paired with business acumen and networking abilities

- Helping to build teams that are effective and proven sparring partners for portfolio companies throughout all phases of the investment

- Help establish effective corporate venture units that can operate within (or outside of) the corporate structure

Engaged Public Equity

Although a comparatively niche strategy, engaged listed equity strategies are proliferating and offer highly effective PE-like exposure, yet with greater liquidity. Click for examples of how we help our clients in the engaged public equity space:

read more

- Building up new offices, especially in the DACH region

- Establishing diverse teams with backgrounds in private equity, consulting, equity research and investment banking

- Establishing or growing institutional fundraising expertise

- Growing or changing internal senior operations teams (finance, HR, management)

Private Equity and Venture Capital Portfolio Companies

Creating value in portfolio companies is the highest priority – either through growth, turn-around, or other strategies. Identifying, securing, and developing the talent responsible for this growth is the name of the game. Click for examples of how we help our PE and VC clients build and strengthen their portfolio management teams:

read more

- Helping assess management teams during the due diligence phase and starting discreet searches, if necessary

- Building new management teams from scratch or helping change C-suite on an individual basis. Focus on CEO, CFO, COO, CTO roles

- Guiding process around Board appointments and functions

- Helping restructure management expertise and reporting lines

Our Services

We partner with both GPs, LPs and family offices as well as fund of funds and relevant service providers across all functions.

360 ° Market-Access

Private Equity | Private Credit | Venture Capital | Infrastructure & Real Assets | Engaged Liquid Strategies | Private Equity & Venture Capital Portfolio Companies

DIVERSITY

Diversity comes in many shapes and sizes, not only gender. Yet gender is a component easily identified and an effective first link to address when building upon the chain that is diversity. Throughout our work, we are committed to working along this chain and making sure to cover the market in its entirety. Sometimes this means that thinking outside of the box and presenting “creative” candidates becomes the norm. Yet, given our longstanding experience in the market and our proximity to talent, we are able to present not only creative but in fact highly effective additions to our clients’ teams.

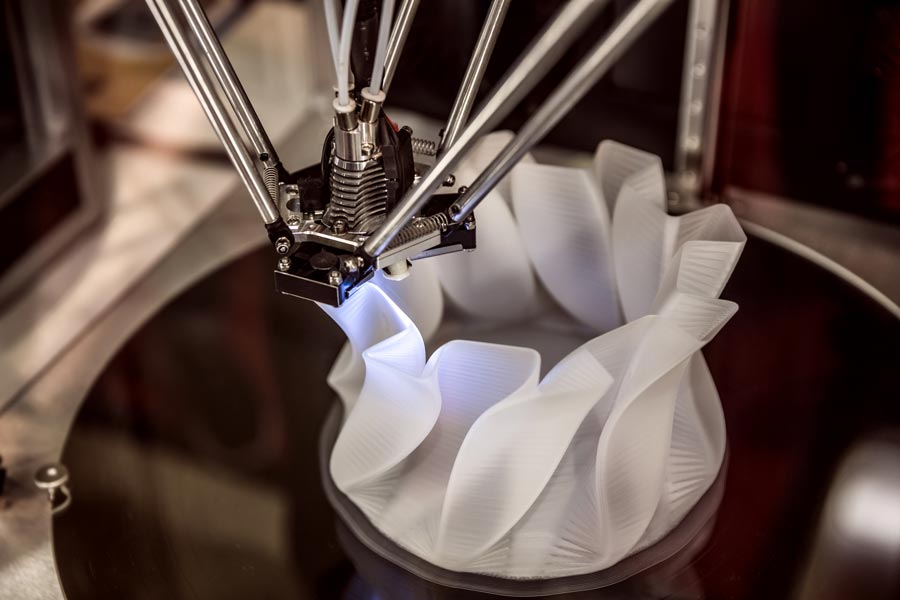

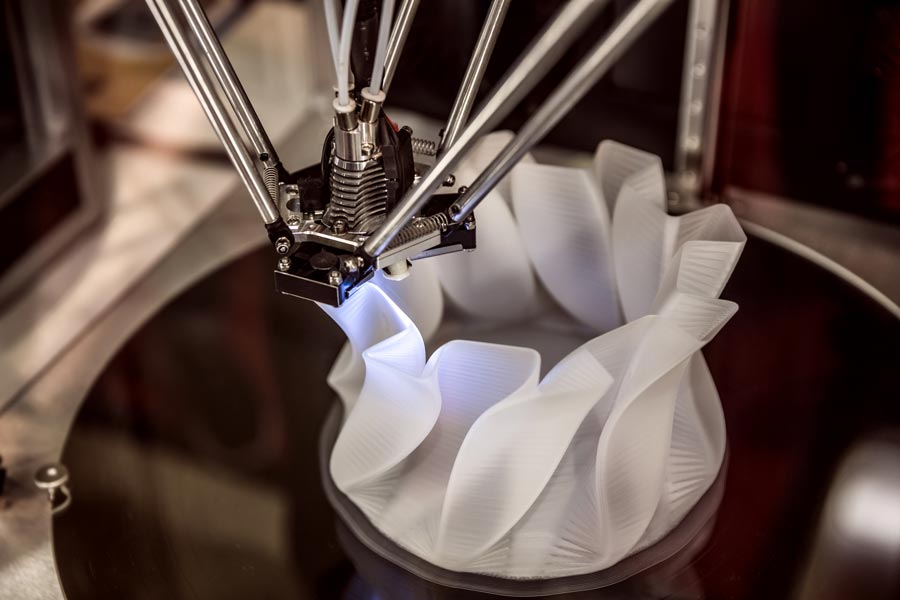

TECHNOLOGY

Technology continues to dominate our world – be it via new business models, efficiency gains through digitalization, or the harnessing of insights made possible by vast arrays of data. Keeping technological progress in mind when working with clients and candidates is key. We want to make sure we stay current as effective sparring partner when discussing our clients’ businesses and provide not only insights but also solutions that are made superior by leveraging state of the art technology and software. From helping to think about business models within our clients’ portfolios to using digital assessment and networking tools, technology permeates our business, both on a practical and strategic level.

ESG

Environment. Social. Governance. Three words that are shaking up the world of asset allocation. Institutional investors are voting with their wallets and private market funds are taking heed. Yet, what exactly will this mean? So far, there is no uniform definition of what an ESG-conform portfolio looks like, and both GPs and LPs are faced with confusion. Given our broad reach across the market spectrum, we are privy to first-hand thoughts and insights on both sides of the isle. And while we can help address ESG from a hiring perspective, we can also be sparring partners to our clients wishing to learn more about other industry players’ thoughts and initiatives.

Mainstay Human Capital Advisory: We are an employee owned human capital advisory firm; rooted in private markets and active internationally. Who we are, contact. Webdesign by 8reasons & Jess Creation